Trip.com Group has Baidu as largest shareholder, over 90% transaction orders from mobile channels in 2022

Trip.com Group, a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged tours and corporate travel management, announced that the Company has filed its annual report on Form 20-F that includes its audited financial statements for three years ended December 31, 2022.

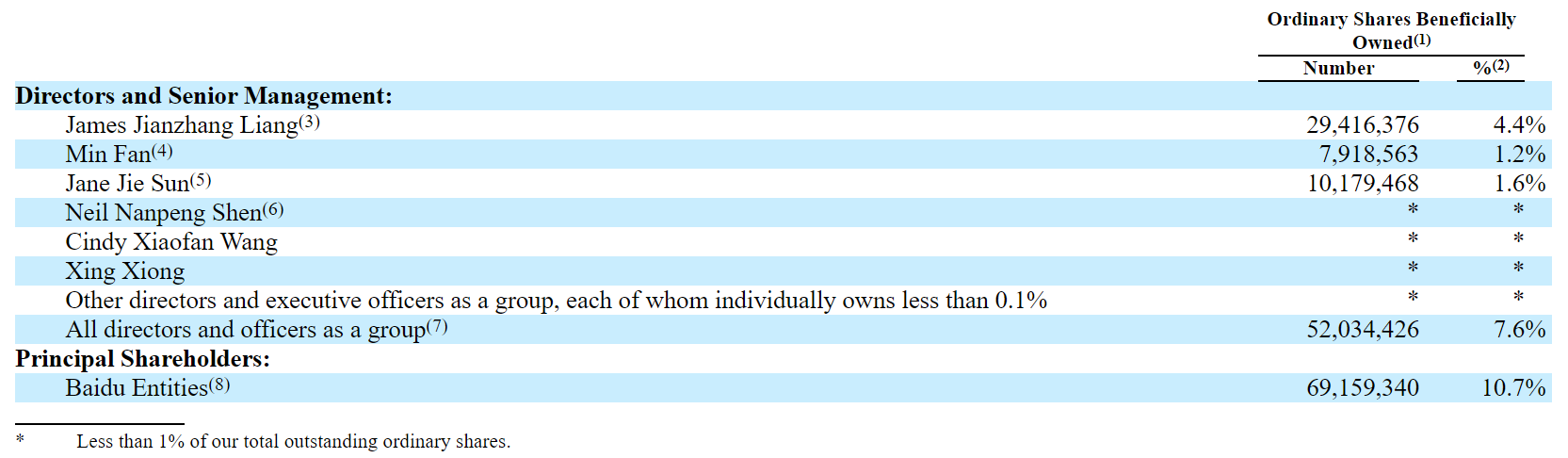

Shareholders

As of January 31, 2023, the beneficial ownership of the group’s ordinary shares by major directors and executive officers is as follow: James Jianzhang Liang (Co-founder and Executive Chairman of the Board, 4.4%), Jane Jie Sun (CEO, 1.6%) and Min Fan (Co-founder and Vice Chairman of the Board and President, 1.2%).

All directors and officers as a group hold 7.6% of the shares.

Baidu, the group’s principal shareholder, owns 10.7% of the shares.

Acquisitions

During the periods presented, the Company completed several transactions to acquire controlling shares to enrich its products and to expand business.

In April 2020, the Company consummated the acquisition of 100% equity interest of an online travel agency with the total cash consideration of EUR 100 million (RMB 772 million). The goodwill recognized for the acquisition was RMB 1.0 billion which primarily made up of the expected synergies from combining operations of the acquiree and the acquirer, which do not qualify for separate recognition.

In September 2020, the Company consummated the acquisition of 100% equity interest of an online payment agency with the total cash consideration of RMB 423 million.

Pro forma results of operations for these acquisitions have not been presented because they are not material to the consolidated income statements for the years ended December 31, 2020, 2021 and 2022, either individually or in aggregate.

Other immaterial acquisitions in 2020, 2021 and 2022 with total consideration of nil, RMB 1.8 million and RMB 8.0 million respectively resulted in no recorded goodwill and recorded intangible assets of nil, RMB 0.5 million and RMB 10.0 million respectively.

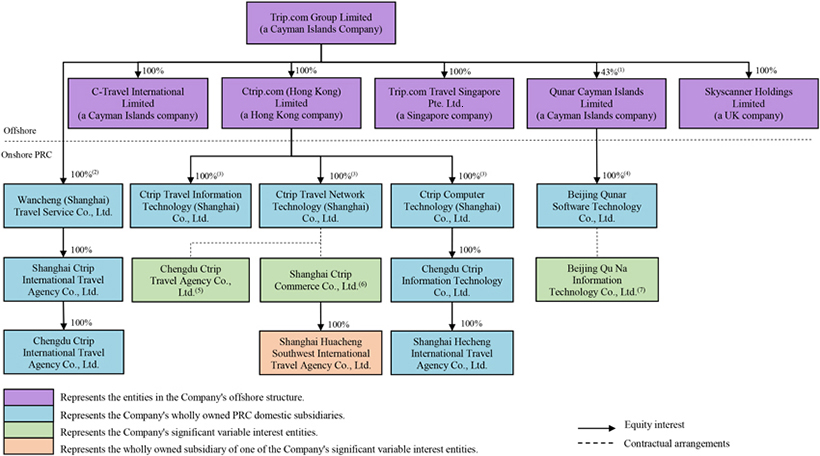

Organizational Structure

The following diagram illustrates Trip.com Group’s corporate structure, including significant subsidiaries and the VIEs as of December 31, 2022.

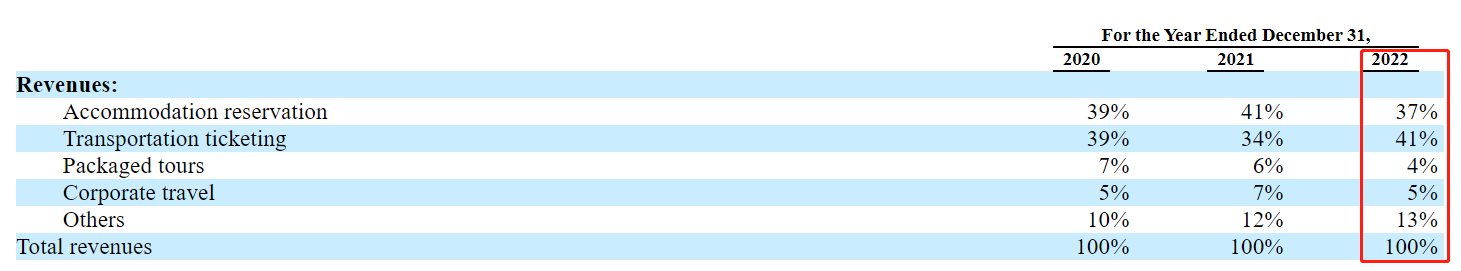

Operating Results

In 2022, Trip.com Group derived approximately 37%, 41%, 4%, 5%, and 13% of the total revenues from accommodation reservation, transportation ticketing, packaged tour, corporate travel, and other products and services, respectively.

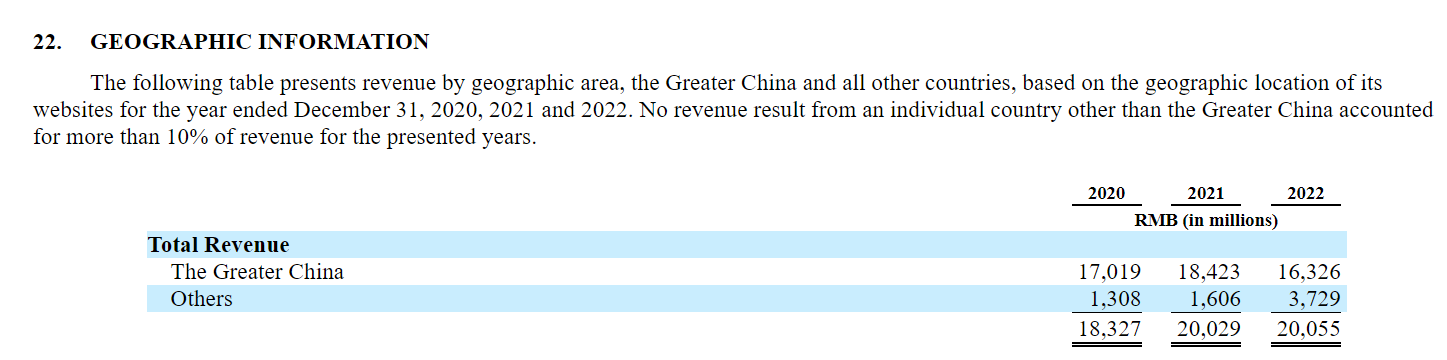

In 2022, the group generated revenues primarily from the Greater China. Revenues from markets outside Greater China accounted for 7.1%, 8% and 18.6% of the total respectively in the year of 2020, 2021 and 2022, indicating faster recovery and growth of overseas markets.

For the year ended December 31, 2022, over 90% of the group’s total transaction orders were executed through mobile channels. As of December 31, 2022, products and services through Trip.com were available in 25 languages and 30 local currencies and local sites, and products and services through Skyscanner were available in 35 languages and over 50 countries and regions globally.

Commissions from Homeinns and BTG

Total commissions from BTG amounted to RMB 38 million (USD 5 million) for the year ended December 31, 2022.

Commissions from H World and its affiliates

Total commissions from H World amounted to RMB 55 million (USD 8 million) for the year ended December 31, 2022.

Commissions and other service fees to/from Tongcheng Travel

Total commissions and other service fees paid to Tongcheng Travel amounted to RMB 21 million (USD 3 million), and total commissions and other service fees paid by Tongcheng Travel to Trip.com Group amounted to RMB 148 million (USD 21 million) for the year ended December 31, 2022.